In the past, male consumers have held firm control of the direction of China’s consumer market for alcoholic beverages. Over the past few years, however, the rapidly increasing number of working Chinese women combined with an enhanced level of self-awareness among female consumers has resulted in a greatly increased purchasing power for the demographic. In fact, the influence of the modern Chinese “she-economy” has become simply impossible to ignore. This trend has certainly manifested in the traditionally male-dominate wine market, as women are transforming the market through their developing views and attitudes toward wine.

According to CBNData’s 2021 Insight Report on Female Products and Lifestyle Trends published in March of this year, the purchasing power of women in the alcohol and beverage industry is skyrocketing, especially when it comes to wine. From this report, it can also be seen that women are bringing fresh and unique perspectives with them to the market.

Feelings-driven drinking habits and rising purchasing power

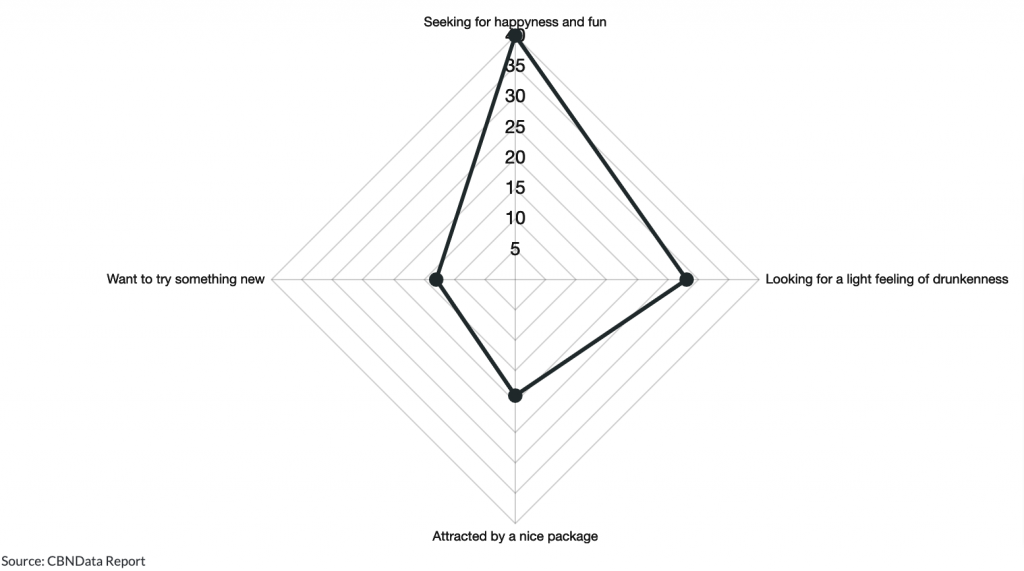

When compared to more traditional consumer markets where business transactions remain the focus, women tend to base their wine purchases more on feeling. According to the CBNData report, 40% of women expressed that their wine drinking habits are dictated by their feelings, such as when they are in a good mood, and 28% indicated that they drink wine for the “tipsy” feeling it gives them.

When do women want to drink

Meanwhile, the new female-driven alcohol and beverage market saw a rapid increase in scale over the period from 2018-2020, as a much larger number of women made a much larger number of purchases.

As for wine brands themselves, this rise of the “she-economy” implies the growing importance of offering more focused content and more convenient purchasing methods, especially online options, directed toward women. Brands should be sure to take full advantage of this enormous business opportunity.

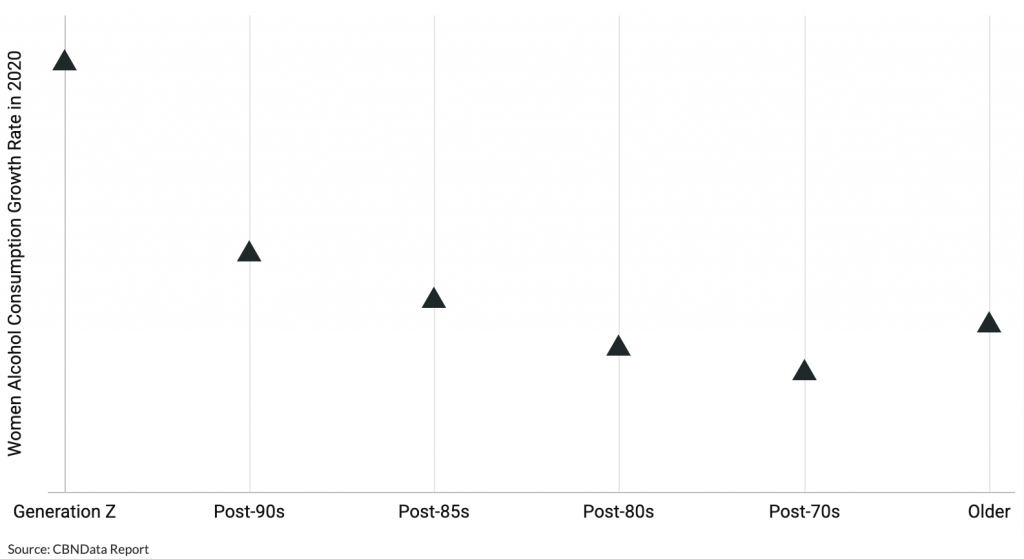

Younger consumers have proven more willing to try new products

From the CBNData report, it can also be seen that a considerable portion of the 2020 female consumer demographic are new or first-time customers who are just beginning to try out wine. Meanwhile, there is also a considerable portion of the demographic who dropped out of the market, and did not purchase any wine in 2020. In other words, more time is needed for real consumer habits to develop and mature.

The report also shows that although purchasing is on the rise across all age groups of female consumers, the largest increase was seen in Generation Z. As they cross over into adulthood, the potential purchasing power of these younger women will only increase the optimism for continued future growth of the Chinese wine market.

Lighter, sweeter, and healthier

Among all alcoholic beverage categories available for online purchase, wines are the most warmly received by female consumers. And, the taste preferences of Generation Z are proving to be skewed toward sweeter and more refreshing wines. As indicated by the 2019 Consumer Behavior in the Chinese Alcohol Market Whitepaper issued by the Hurun Research Institute, the influence of the female consumer demographic is still on the rise.

With this in mind, it is worth noting that women place a greater importance on the sweetness of their wine than do men, while studies have also shown that women prefer alcoholic beverages that are lower in alcohol content and that possess certain beautifying benefits for the skin and coloring. These factors are initiating major changes in the market as a whole.

The influence of the pandemic on the wine “she-economy”

Throughout the coronavirus pandemic, this shift of China’s wine and liquor market toward a “she-economy” continued strong. Married middle-class women and young businesswomen have become the market’s primary consumer demographic, and they have so far shown to favor imported wines and liquors.

Married middle-class women and young businesswomen have become the market’s primary consumer demographic, and they have so far shown to favor imported wines and liquors. In contrast to the traditional male consumer who prefers liquor, beer, and baijiu, female consumers tend to avoid these products. Instead, these women turn to wine, which they see as more refined, mature, trendy, and stylish.

In contrast to the traditional male consumer who prefers liquor, beer, and baijiu, female consumers tend to avoid these products. Instead, these women turn to wine, which they see as more refined, mature, trendy, and stylish. Compared with liquor and baijiu, wine also features a more moderate alcohol content.

Wine brands are responding to this shifting consumer demographic with new products and marketing campaigns

Setting their sights on these powerful female consumers, many companies are beginning to introduce light wines, sparkling wines, and other similar products, while also adjusting their marketing and promotional methods to match female tastes. On several of the major e-commerce platforms, products advertised with targeted keywords such as “low-sugar” and “low-calorie” have been met with tremendous sales figures.

On several of the major e-commerce platforms, products advertised with targeted keywords such as “low-sugar” and “low-calorie” have been met with tremendous sales figures.

Searching one of these online platforms with the keyword “sparkling wine,” reporters discovered that the majority of products were imports featuring beautiful packaging aimed at young women. Take sparkling wine gift boxes as an example; with sales of over 4,000 units per month, the vast majority of purchases made by female consumers, the reviews sections for these products were filled with comments referencing “girlfriends’ day gifts” and “aesthetically-pleasing.”

Female wine drinkers are making their taste and style preferences clear to sellers

The Alibaba Group’s flagship cross-border e-commerce platform, Koala, has released data showing that China’s female wine drinkers prefer fruit-flavored liquors, wines, cocktails, and sake. The products they enjoy are typically lower in alcohol content, have fruity aromas, and feature attractive packaging. The most popular types of wine among young female consumers in China are Cabernet Sauvignon, Syrah, Merlot, and Pinot Noir.

Harvey, the founder of the low-proof, female-targeted wine brand Mary Shelley, says that the number of female wine drinkers in China has greatly increased over the past few years, and that the market has responded with an influx of products that present themselves as premium goods. However, domestic Chinese brands have yet to truly enter this premium, female-targeted sector.

Mary Shelley is considered one of these premium brands, and as such it is targeted towards 26-40 year old female consumers, meeting the demographic’s demand for suitability across a wide range of uses, including individual drinking, social drinking, and gift giving. The brand has been able to successfully penetrate the market with its sweet wines; its products officially came online in April of 2020, and today have amassed sales numbers in the millions of yuan.

What might the future hold for this red-hot market?

Harvey says that the female consumer market for wine has been predicted to reach 10 billion yuan within the next three years, but adds that the current sweet wine market “has products, but not brands.” This type of wine has an addictive quality, and there exist great opportunities for major brands to succeed in the market. In fact, many brands are eager to get their horse in the race, as they first enter the market at its developing stage and plan to continue expanding as the market matures.

Female consumer market for wine has been predicted to reach 10 billion yuan within the next three years, but the current sweet wine market “has products, but not brands.” There exist great opportunities for major brands to succeed in the market.

Finally, according to the manager of one Western-style restaurant, women dining at the restaurant have been more inclined to choose a lighter wine with aesthetically pleasing packaging as compared to the typical high-proof beverage. A frequent patron of the restaurant, Ms. Chen, told reporters that she and her circle of “wine friends” will occasionally gather for in-person wine events. “Our group of friends prefers wines that are lower in alcohol content, and we’re all drawn to the aesthetics of the product’s presentation. However, when we’re dining out, wine is more of an adornment than the focal point.”