Table of Contents

- Introduction

- Understanding the Chinese Market

- Getting to Know Chinese Wine Consumers

- Domestic Wine Production

- Who Are the Key Players in China’s Imported Wine Market

- How to Enter the Chinese Market

- Using Digital Platforms & E-commerce to Boost Your Sales and Build Your Brand Awareness

- How to Connect with Chinese Consumers

- Conclusion

Introduction

China is the world’s fifth-largest market for wine consumption by total volume, and as more mature wine markets become saturated and highly competitive, it is now considered by wine producers to be the world’s most promising market for future growth. Despite the huge size of the Chinese market, wine consumption volume per capita in China is 40 times less than in France. Indeed, the market still has huge potential when considering the growing incomes and wine consumption habits of Chinese consumers. However, finding success in the Chinese wine market is far from a sure bet, and requires a comprehensive and well-researched strategy.

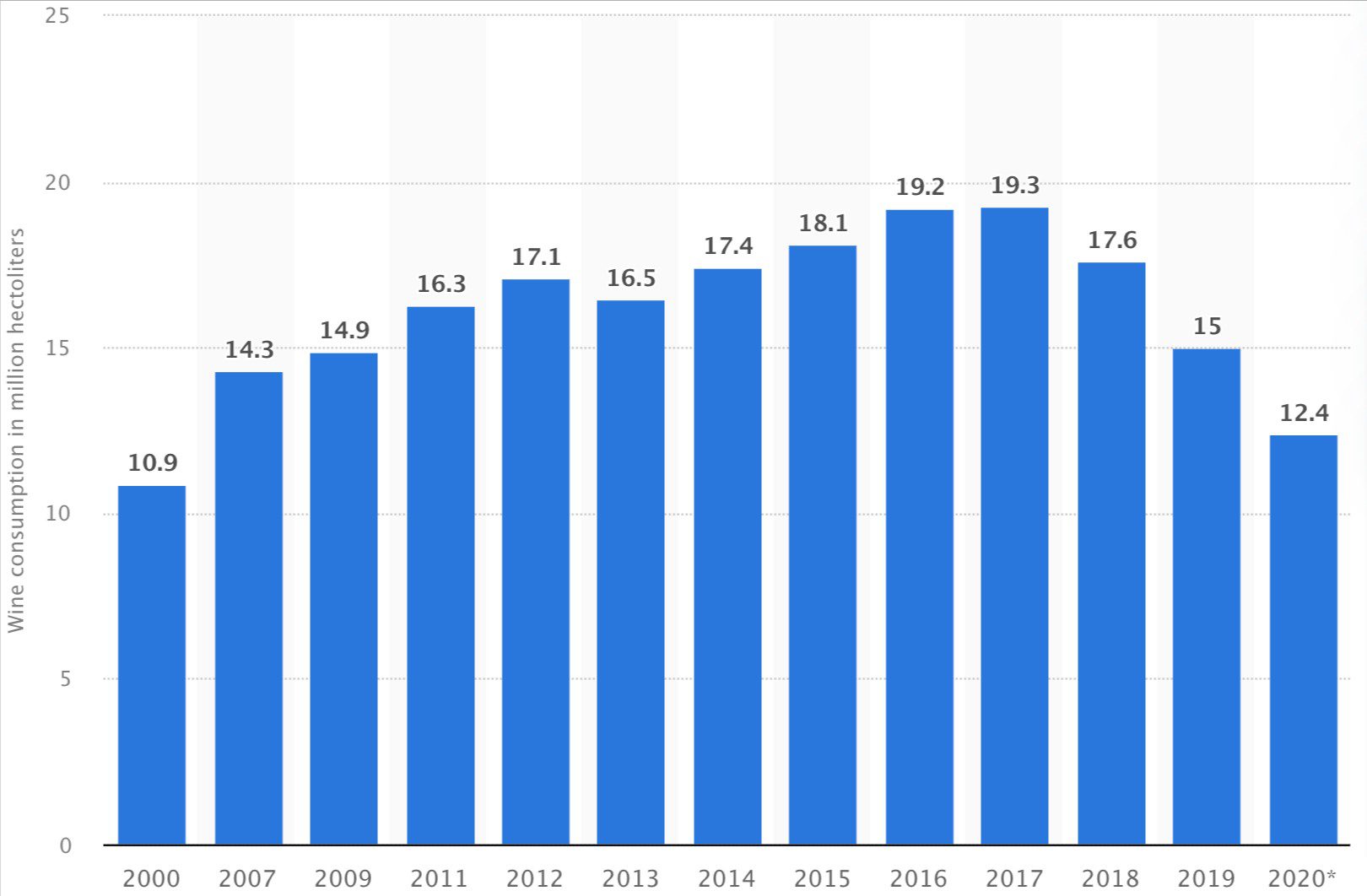

Following right alongside the country’s fast-growing economy, the wine market in China has been changing rapidly. In the late 1990s, when pioneering wine importers such as ASC Fine Wines were founded, imported wine began appearing in the country’s larger cities. In the 20 years since, Chinese wine consumers went from adding Sprite to mass-produced domestic wine to being much more selective about the quality and the taste of their wines. The wine market in China had its first peak over the period from 2010 to 2012, but this was soon followed by a sharp decline resulting from the anti-corruption policy that was introduced in 2013. Starting in 2014, wine consumption in China shifted from catering, entertainment, and extravagant gifting for government officials towards personal consumption. Now recovered from the decline caused by the anti-corruption policy, the market enjoyed its second peak from 2015 to 2017, during which Australian wines, especially Penfolds, found great success in China. In late 2018, the Chinese wine market began a slow decline as a result of a stagnant economy and was then hit by the pandemic in early 2020, resulting in a drop of 17.4% compared to the wine consumption in 2019. However, the pandemic drove many new trends in addition to these negative impacts, as it pushed e-commerce and social commerce to a whole new level.

Uncertainty is a key feature of the Chinese wine market that should not be overlooked. Aside from the drastic decline, it suffered during the pandemic – while other major wine consumer markets like the United States, the EU, the UK, and Russia remained stable – the punitive tariff imposed by the Chinese government on Australian wines will reshape the country’s wine market for years to come. New challenges are inevitable due to the complicated nature of the Chinese wine market, as it remains largely influenced by political and socio-economic factors, but new opportunities are presenting themselves every day as the consumer base is growing and the market is maturing.

Understanding the Chinese Market

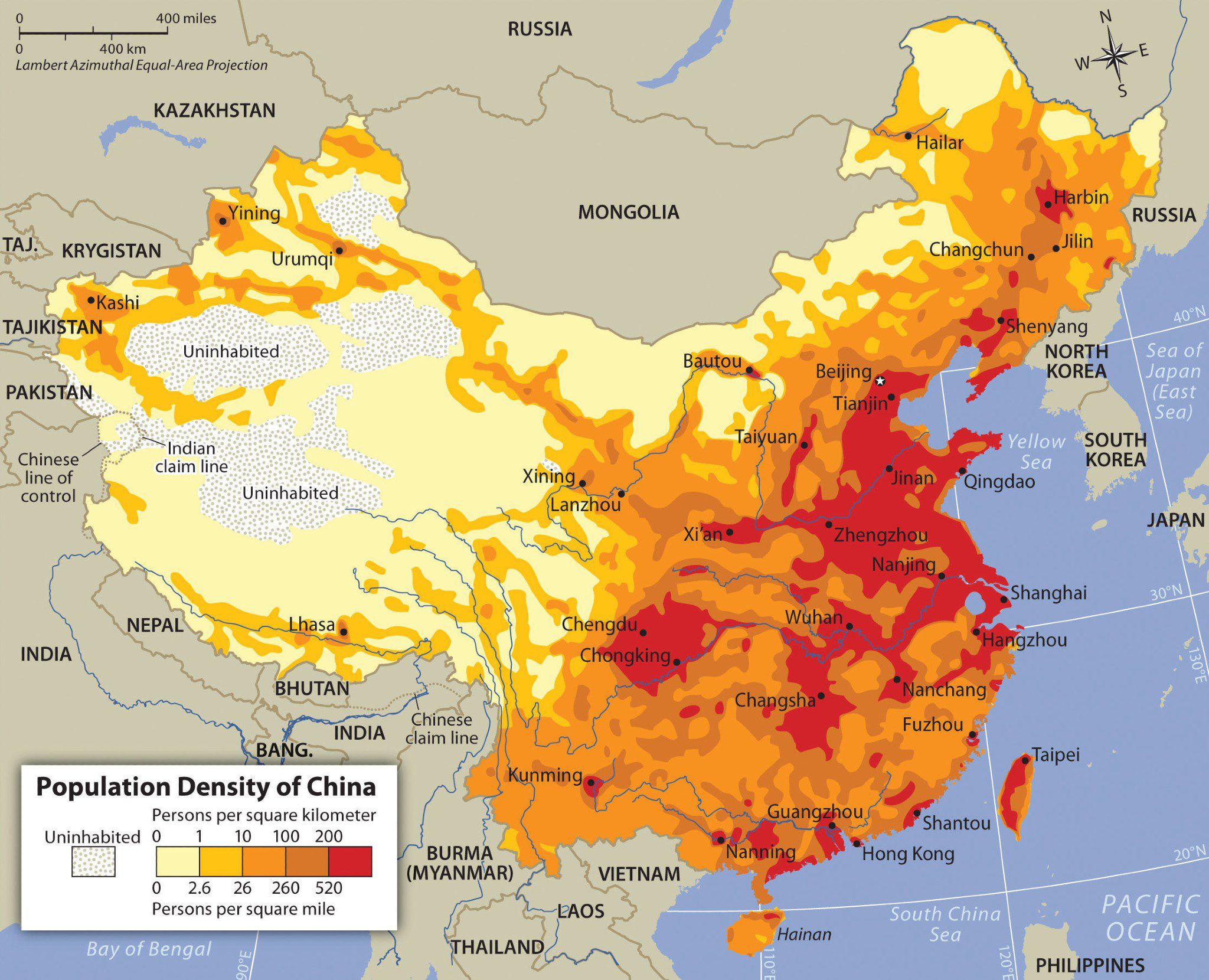

For a market containing 1.4 billion people and huge regional differences, it is impractical to look at the Chinese market as a whole. Culturally speaking, the coastal regions and big cities in the eastern part of China are important to international trade and have been influenced by the Western lifestyle. Big cities and affluent regions also have higher income levels and more disposable income. According to data from the China Alcoholic Drinks Association (CADA), the country’s bottled wine consumers are concentrated in coastal cities and provinces like Guangdong, Zhejiang, Shanghai, and Beijing. The province of Guangdong alone accounts for roughly 30% of the country’s total import value of bottled wine.

The differences in economic development among regions are directly reflected in their distribution structure and consumption patterns. Economists and marketers often divide the cities in China into tier groups to aid in planning and analysis. First-tier cities such as Beijing, Shanghai, Guangzhou, and Shenzhen tend to have the features of mature wine markets. Second-tier cities, including affluent cities near the first tiers and provincial capitals, are quickly catching up. Smaller cities in inland regions have great potential as they are reached by the rapid development of the economy and income increases.

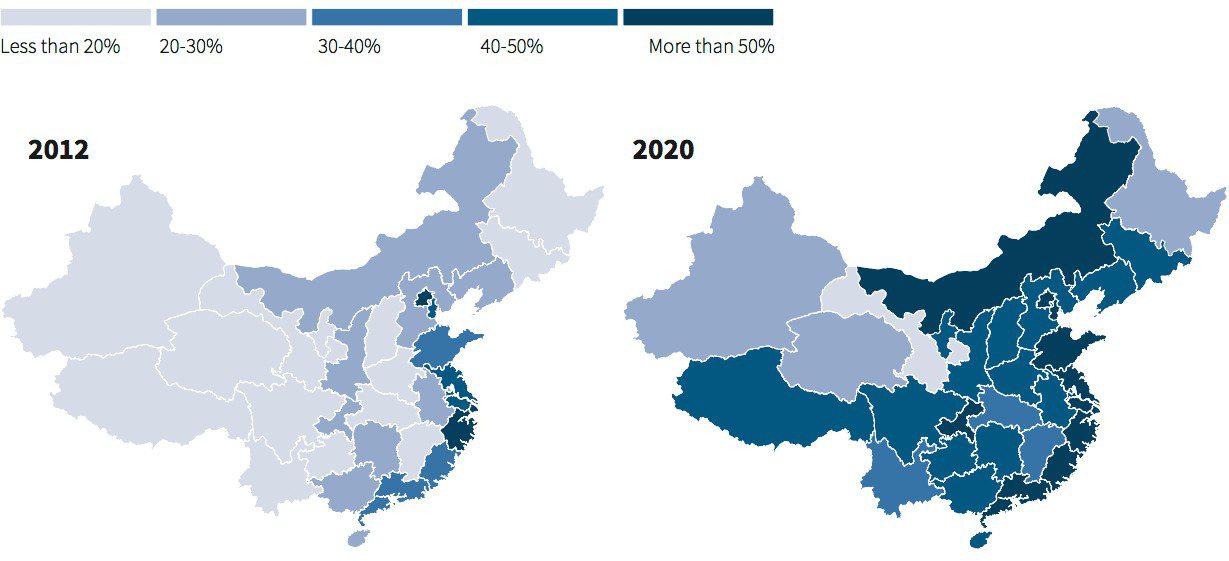

Middle and affluent urban households as a percentage of total urban households

In first-tier cities, most notably Shanghai, the wine market is highly competitive. Thousands of wine importers of varying operational sizes and product mixes are based in first-tier cities. The distribution structure in these cities is complete and comprehensive, covering on-trade, off-trade, e-commerce, corporate purchasing, and private club channels. The level of sophistication of wine consumers in first-tier cities is much higher than in other regions. Wine consumers in first-tier cities have greater access to a wide range of wines, and their wine education level is relatively high. In recent years, wine bars specializing in natural wines, sherry, or particular wine production regions are booming in first-tier cities, as the industry targets the growing number of niche wine drinkers located in these areas. In second-tier cities and inland regions, the market is less fragmented and less competitive. Distributors and merchants with a strong local presence may be able to capture a large share of the market. Wine consumers in these areas know less about wine and wine regions, and tend to choose high-drinkability wines and reliable brands.

Consequently, it is essential to divide the Chinese market into different sub-markets and plan different strategies that best suit each one. These differences have a direct impact on the optimum distribution plans, marketing and communication strategies, and product segmentation for each region.

Getting to Know Chinese Wine Consumers

What type of wine do Chinese consumers prefer?

The wine market in China is heavily dominated by still red wine. Traditionally, the Chinese word for “red wine” (红酒) is used to refer to all wine in general, while the word for “white wine” (白酒) actually refers to Chinese spirits, or baijiu. Red is seen as a favorable color in China, signifying good luck, prosperity, and happiness. Red wine is perceived to be sophisticated and carry health benefits, while white wines are less popular due to their acidity and Chinese consumers’ aversion to chilled drinks.

Compared with other large wine-consumption markets, the market shares of still white wine, still rosé wine, and sparkling wine remain relatively small. According to data from Euromonitor, in 2020, around 75% of the still wines sold in China were reds, while still rosé wines accounted for less than 3%. This imbalance between wine categories is gradually changing over the years, however. As the wine market grows, Chinese wine consumers are becoming more accepting of fruity, aromatic white wines and sparkling wines – especially female consumers. According to Euromonitor, the sales volume of sparkling wine skyrocketed over the decade from 2010 to 2019, and although it suffered a hit from the pandemic in 2020, it is already seeing a recovery in 2021.

Wine consumption volume in China from 2000 to 2020

Taste and consumer behavior

Because of the early entry of Bordeaux wines and the success of Penfolds in the market, Chinese consumers are already accustomed to fruity, full-bodied red wines. Various research and surveys have shown that Chinese wine consumers prefer medium- to full-bodied wines with distinctive fruity aromas and flavors and low levels of acidity and tannins. Baby boomers and male Gen Xers are the driving force behind increased wine consumption in China, due to their larger disposable incomes and an increased need to consume premium wines for business purposes. They tend to be more conservative in choice and more loyal to prestigious brands and traditional wine regions. With the increasing size of the urban middle class, millennial wine consumers have grown more educated about wine and associate wine consumption with gastronomy and sensory pleasure.

With the increased health-consciousness of consumers and the growing number of choices on the market, the concept of “drink less, but better” is gradually becoming accepted by more Chinese wine consumers.

Compared with the older generation, millennials are more open-minded in terms of their wine selection. For these younger consumers, taste matters more than brand names. With the boom of the “She Economy”, female consumers have also grown increasingly important in the wine market, driving the consumption of white, rosé, and sparkling wines. In the whitepaper released by the Hurun Institute in 2019, self-consumption is the primary reason for female drinkers to buy wine, while male drinkers primarily purchase wine for catering. Generation Z is emerging as a new group of wine consumers, with a preference for fruity wines with appealing labels that are lower in alcohol content. With the increased health-consciousness of consumers and the growing number of choices on the market, the concept of “drink less, but better” is gradually becoming accepted by more Chinese wine consumers. Low alcohol wines and minimal intervention wines such as organic wines, biodynamic wines, and natural wines all have positive momentum in the market.

Where do Chinese consumers buy wine?

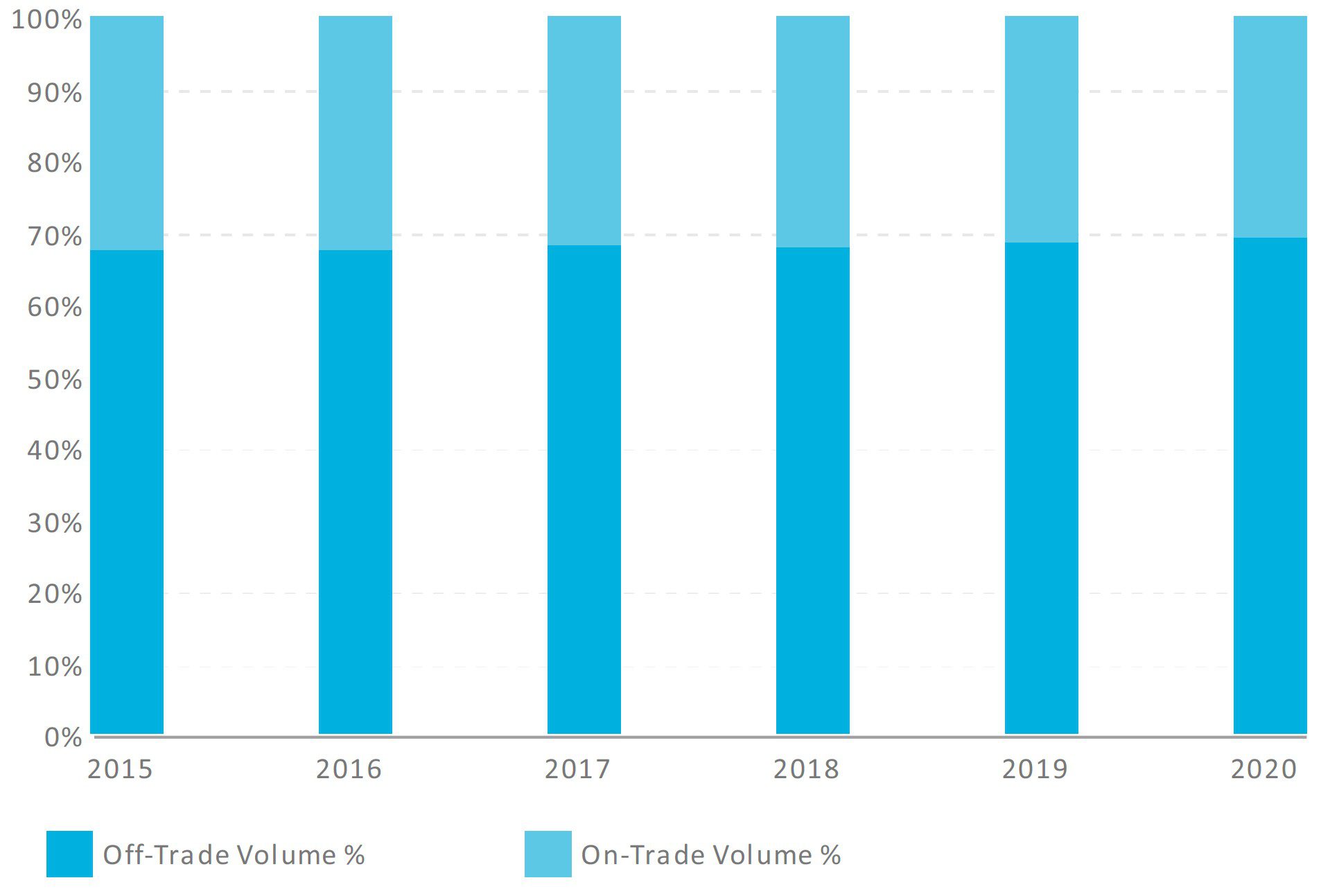

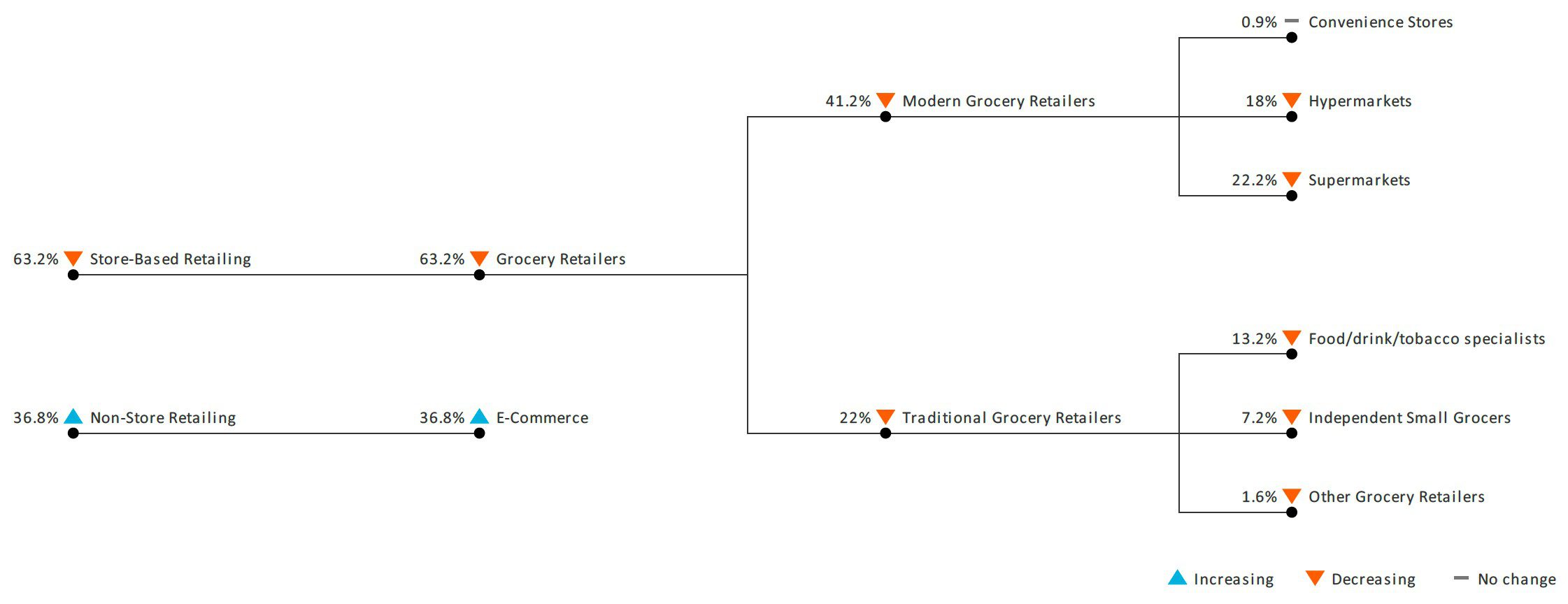

In general, wine distribution in China is strongly off-trade dominant. Off-trade channels account for 70% of the total sales of wines in China. Culturally, wine is considered an imported good and is not associated with Chinese cuisine; therefore, it is not a daily necessity for inclusion on Chinese dinner tables. According to Euromonitor, over 40% of off-trade wine sales in China are contributed by hypermarkets and supermarkets, and over 20% of the total wine sales in China are through e-commerce. Benefitting from the country’s highly developed technological infrastructure and well-established logistics network, e-commerce reaches a massive number of Chinese consumers.

Wine distribution channels off-trade vs. on-trade in China, from 2015 to 2020 (breakdown by volume)

Channel Distribution for Wine – Off-trade Volume 2020 and Percentage Point Growth – 2015-2020

In recent years, large e-commerce distributors have started opening brick-and-mortar flagship stores, providing their customers an offline tasting and purchasing experience. This method appears to have a promising future within the wine industry when paired alongside e-commerce. In 2018, e-commerce began its move towards social commerce with e-commerce retail based on social media platforms. “E-commerce Madman,” a third-party service provider in China, released data showing that the annual sales volume of alcoholic beverages generated by video content and livestreaming on Douyin has reached CNY 990 million. A unique phenomenon in the Chinese market is that consumers purchase their wine at off-site locations or through e-commerce, and then consume the wine at on-site locations.

When do Chinese consumers buy wine?

The peak seasons for wine sales in China are the holiday shopping seasons before the Chinese New Year and Mid-Autumn Festival, especially among those who purchase wines for catering, events, and gifting purposes. In contrast, the period from April to July is when wine sales volume is normally lowest. For online sales, November 11th is the biggest online shopping day of the year across all categories. During the 11.11 Shopping Day of 2020, sales of alcoholic beverages increased by 900% compared with 2019. Tmall by Aligroup introduced the “9.9 Global Wine & Spirits Festival” in 2016, which has become the other online shopping festival of greatest importance to wine sellers.

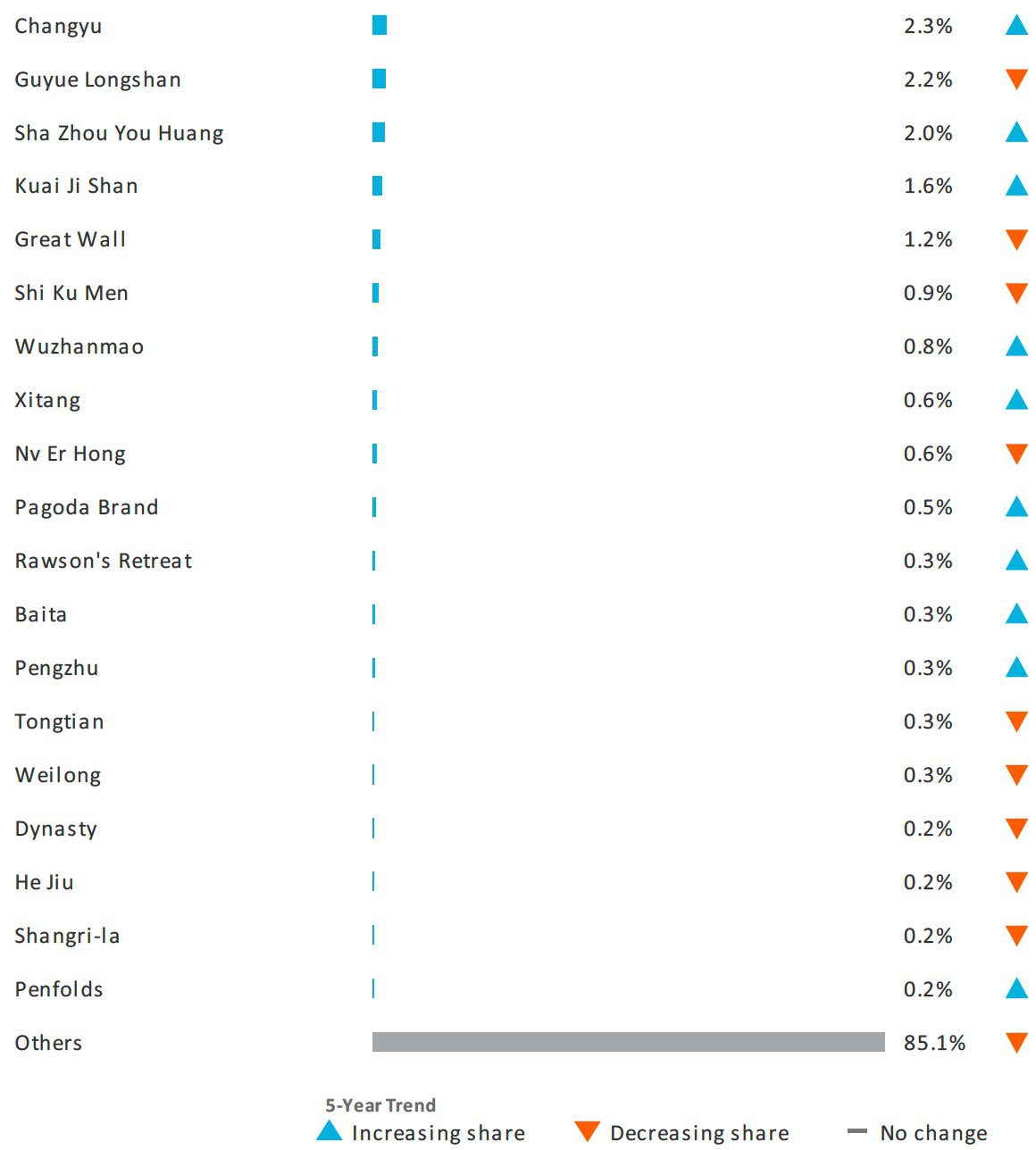

Top Wine Brands in China (% Share – Total Volume – 2020 – Still Light Grape Wine)

Domestic Wine Production

The production of grape wine in China dates back more than two thousand years, although modern winemaking is considered to have started in the late 19th century. Changyu, founded in 1892, is China’s first and oldest wine-producing company. Today, the country’s wine-producing regions are primarily located in northern China, northwest China, and in high altitude regions of the southwest province of Yunnan. In 2020, China exported 1.5 million liters of grape wine, totaling USD 26 million in value (United Nations data). Comparing this number to the country’s overall production volume, it is clear that most Chinese wines are consumed domestically.

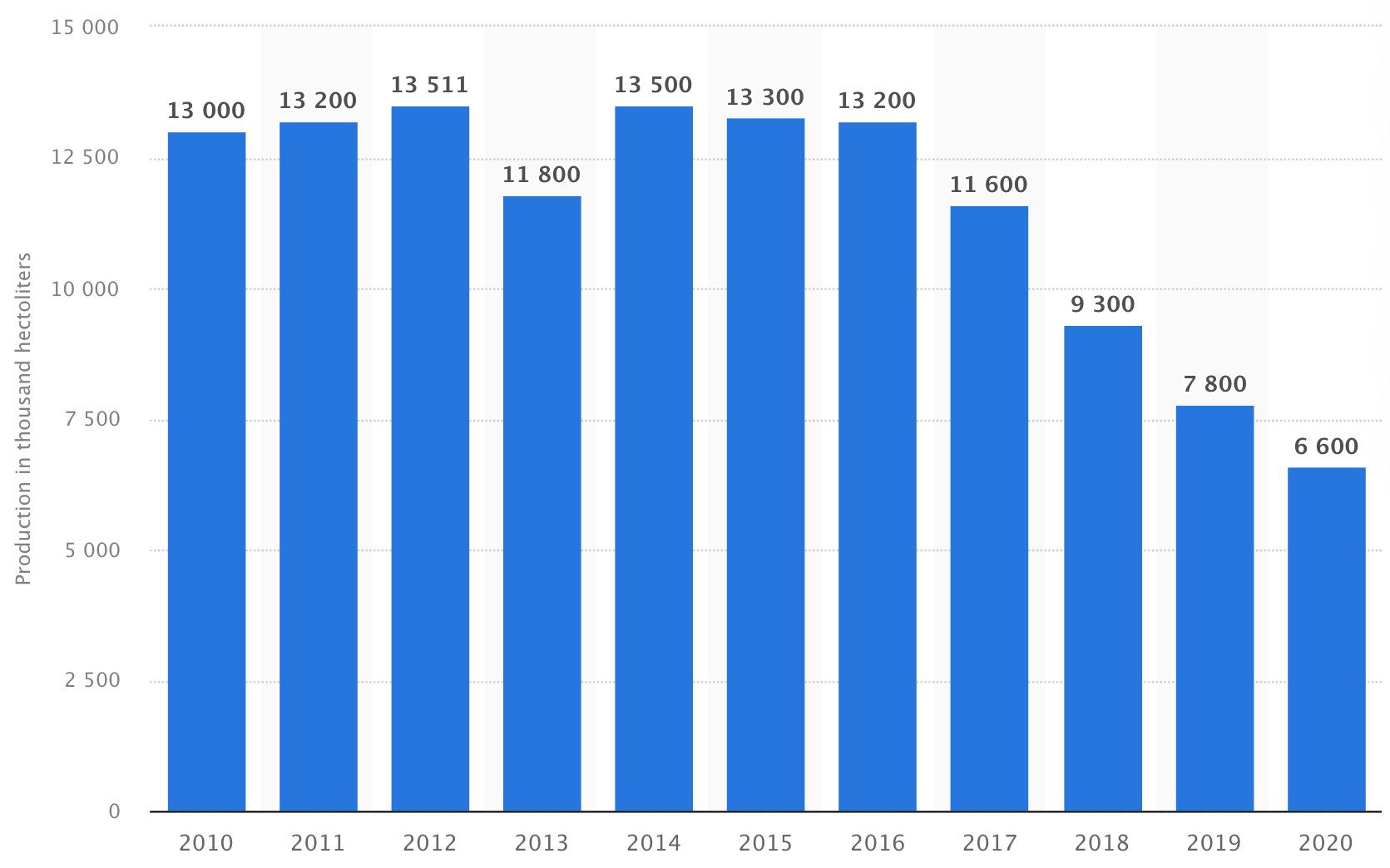

According to data from the Chinese National Bureau of Statistics, there were 155 wine-producing companies in China in 2019, with total wine production of 4.5 million hectoliters. This is a year-on-year decrease in production of 10.09%, while sales revenue decreased by 17.51% over the same period. During the five years from 2015 to 2019, domestic wine production, sales, and profits all declined.

Wine production volume in China from 2010 to 2020

Despite the decline in volume and value, China’s domestic wine industry is growing. Previously dominated by mass-produced wines from the big wineries, the domestic wine industry has now shifted toward premiumization and standardization, gaining more and more international recognition driven by boutique family wineries in Ningxia and Shanxi. In July 2019, the Group Standard Review Committee of the China Alcoholic Drinks Association issued its group standards for “Wine Grapes” (T/CBJ4101-2019) and “Oak Barrels” (T/CBJ4102-2019), in a move to standardize the winemaking process in China and promote domestic wines. Additionally, in November 2019, CADA released a “Grape Wine Production Area” draft that will create a standard for the country’s wine-producing regions.

Notable wine producers in China

- Changyu

- GreatWall

- Domaine Baron Rothchild Longdai

- LVMH Aoyun Shangri-la

- Grace Vineyard

- Silver Heights

- Domaine des Aromes

Learning the Key Players in China’s Wine Import Market

Imported wines account for approximately half of the wine market in China. From 2010 to 2020, imported wines showed a significant increase in volume as well as in value. The 2020 pandemic hit the country’s wine consumption numbers, as well as its wine import volume, hard. Despite the drop in 2020, as domestic wine production decreases, imported wine takes a larger portion of the total market share. The average price of imported wines shows steady growth over the last 10 years.

France has long been the leader among countries exporting wine to the Chinese market. Having entered the market the earliest, France has kept its dominant status among the old world countries, still holding a higher average price than Italy and Spain. The reputation of French wine in China has been driven by Bordeaux and en primeur. In recent years, however, the country’s Bordeaux fever has cooled down and the ultra-premium and cult wine sector of French wines has shifted to Burgundy. The brands under Domaines Barons de Rothschild are still among the most valuable in the Chinese market.

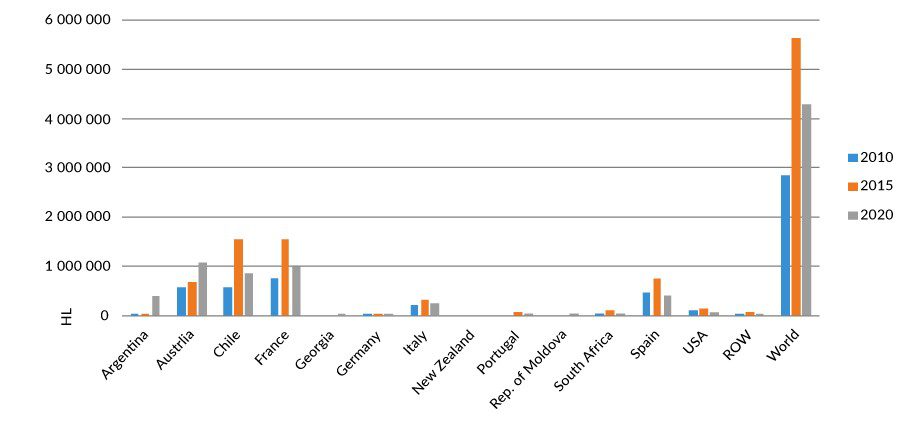

Top wine import countries by volume in China from 2010 to 2020

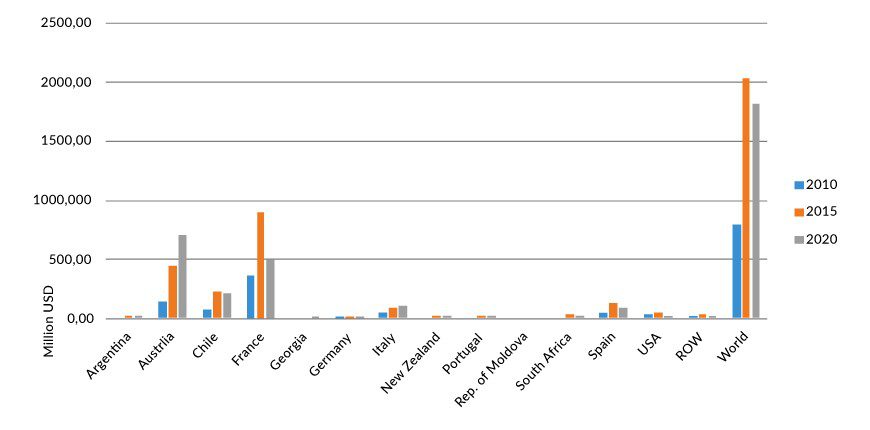

Top wine import countries by value in China, from 2010 to 2020

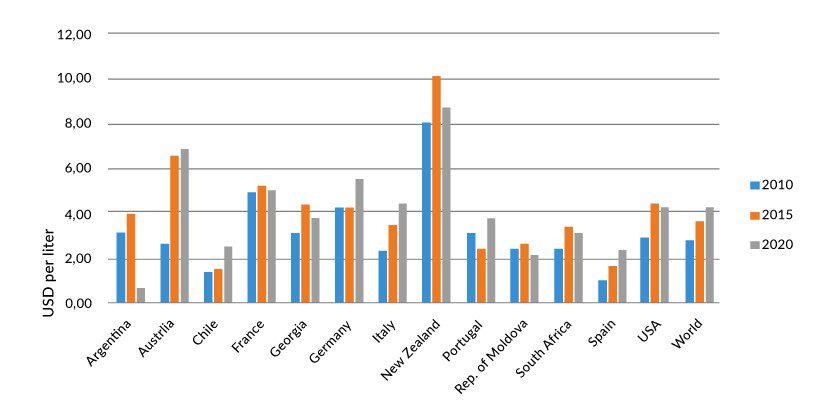

Top wine import countries average price in China, from 2010 to 2020

China’s Top 10 Wine Importing Countries from January to August 2021

| Rank | Country | Value in 2021 | Value in 2020 | % Change |

| 1 | France | US$485,904,592 | US$304,393,719 | +60% |

| 2 | Chile | US$219,958,920 | US$139,244,614 | +58% |

| 3 | Italy | US$116,669,314 | US$72,789,278 | +60% |

| 4 | Spain | US$98,677,704 | US$62,894,100 | +57% |

| 5 | Australia | US$52,818,770 | US$457,516,342 | -88% |

| 6 | United States | US$27,079,991 | US$14,291,195 | +89% |

| 7 | Argentina | US$24,165,9409 | US$17,479,899 | +38% |

| 8 | South Africa | US$20,750,949 | US$9,071,277 | +129% |

| 9 | Germany | US$17,790,045 | US$11,608,411 | +53% |

| 10 | New Zealand | US$15,517,779 | US$11,103,128 | +40% |

| Total | US$1,127,698,648 | US$1,142,067,315 | -1% |

After signing the Free Trade Agreement with China in 2015, Australia took over first place from France and became the number one source country for Chinese wine imports. The success of Penfolds and other brands from the Treasury Wine Estate contributed to their growth in value too; the hype behind Penfolds wines even led to some serious counterfeit and fraud issues. However, the honeymoon period ended in December 2020, when the Chinese government imposed a punitive tariff on Australian agricultural products. The big market share left by Australia was soon captured by France, Chile, Italy, and Spain.

For a long time, Chile was a source of cheap, bulk wine for the Chinese market. In recent years, however, Wines of Chile has been actively promoting high-quality, bottled Chilean wines in China with great success. The average import price of Chilean wines has increased significantly. The United States has seen a drop in volume and value since 2015, as a result of the tension between the two economic powers. New Zealand and Germany are two more important players in the premium wine category, as they hold the highest average import price among all countries. Benefited from the FTA, Georgia has now become a rising star in China’s imported wine market.

In 2019, there were nearly 4,000 licensed wine importers in mainland China, though this number had dropped by 35% compared to 2018 according to data from Chinese government authorities. Importers in China operate as distributors as well. With the little restriction in alcohol distribution in China, there are several large national importers, including ASC Fine Wines and Summergate, that cover all distribution channels and represent dozens of brands from all over the world. Changyu, the domestic giant, owns several wineries overseas and imports both bulk and bottled wine under its own label, while smaller importers often focus on a certain geographic area or a certain product mix. However, due to the lengthy logistics and sales processes, cash flow can be a big challenge for small importers, and they are easily influenced by the current economic climate.

Top wine importers in China

- ASC Fine Wines

- COFCO

- Summergate

- Changyu

- Torres China

- Wajiu.com

- EMW Wines

- Links Concept

How to Enter the Chinese Market

Entering and succeeding in a new market is never easy. For a complex market like China, with its huge size coupled with language and cultural barriers, it is important to do some research beforehand. Having a clear objective of what you want to achieve in this market and setting up realistic expectations are the first steps. Understanding the market landscape, local consumer behavior, and the distribution structure can help you choose the right products and the most effective route to market for your brand.

Tradeshows are the most effective way to find and secure importers or distributors. Internationally recognized wine fairs including ProWein, Vinexpo, and Vinitaly all have Chinese editions. The China Food and Drinks Fair (or known as “Tang Jiu Hui”) is the largest trade fair within China’s food and beverage industry, with a long history spanning over 60 years. The trade fair is not exclusive to alcoholic beverages, but as the imported wine market continues to grow, the fair has added a special trade show dedicated to imported wines. In addition to the big wine fairs, there are some regional wine fairs and smaller events held by the interprofessional association of wine regions, local governments, and specialized agencies.

Because of the high cost of participating in these trade shows, you must select the right fairs and be well-prepared in order to achieve your goals while attending. Due to the tight schedule of the wine fair, it may be difficult to set up official meetings with potential importers during the event. Oftentimes, it is more important just to make an initial connection. For this reason, it is better to hire a brand ambassador, representative, or agency that understands the Chinese market and its business culture to ensure effective communication and smooth negotiation.

Major wine fairs in China

- ProWine Shanghai

- Vinexpo

- Wine to Asia

- China Food & Drinks Fair, or in Chinese “Tangjiuhui”

- Interwine Guangzhou

- Superwine Shanghai

- Topwine Beijing

- TOEwine Shenzhen

Using Digital Platforms & E-commerce to Boost Your Sales and Build Your Brand Awareness

E-commerce platforms

It is nearly impossible to expand in the Chinese market without making considerations for e-commerce. Ever since the Chinese government strengthened e-commerce anti-counterfeiting regulations, wine sales through e-commerce platforms have reached a 10% annual growth rate. Compared with other consumer goods, e-commerce in the wine industry is yet to reach the same levels of omnipresence, but the current momentum is promising.

E-commerce giants such as Tmall, Taobao, and JD.com have nearly universal coverage of the Chinese market. Major importers, distributors, online retailers, and even some brand owners have opened official online shops on Tmall and JD.com. And, in China, e-commerce does not merely serve as an online sales generator; many smaller wine companies get their start online, and as their business grows, their success extends to offline opportunities as well. Online sales during the 11.11 Shopping Day and 9.9 Global Wine & Spirits Festival are certain to help build a positive brand image, too.

Social media platforms and social commerce

The digital ecosystem in China is a special case, as the major social media platforms like Facebook, Instagram, Snapchat, Youtube, and Pinterest are banned in the country. Unlike these international social platforms, which are usually linked to each other and each designed to serve different purposes, the main social platforms in China belong to different tech groups and tend to be multifunctional.

In China, WeChat is the most important social network, with around 1.2 billion users as of the end of 2020. The platform is widely used in the daily lives of most Chinese people, both personally and professionally. WeChat started as an instant messaging application, but quickly developed additional functions such as Moments (similar to Facebook), Official Accounts (content platforms), Channels (short-form videos), mini-apps for business (e-commerce shops), and more. WeChat is a great tool to gather followers through content marketing and convert them to sales.

Weibo (the Sina mini-blogging platform) is another influential social platform that is roughly the Chinese equivalent of Twitter. It is community-based and topic-based, with over 500 million monthly active users. Thanks to its many useful features, Weibo is a powerful tool for creating trending content and engaging with your audience. Douyin (Tiktok) and Kuaishou have also been gaining popularity rapidly in recent years – especially after the pandemic. Short-form videos and livestreaming content are the new favorites for Generation Z users and beyond. The number of daily active users on Douyin is estimated to hit 680 million by the end of 2021. Douyin has also launched e-commerce shop functionality within the platform, and in 2020, the average monthly sales volume of alcoholic beverages generated from Douyin reached CNY 80 million.

Other platforms like RED (Xiaohongshu), Zhihu, and Toutiao have more specific features and audiences. RED is a hub for user-generated content, where users are mostly of the millennial and generation Z female demographic, living in first and second-tier cities. Users of RED are highly interactive and have high conversion rates, and the platform also provides e-commerce services that allow users to make direct purchases from viewed content. Zhihu (the Chinese Quora) and Toutiao (a news platform) are content platforms that can help improve SEO in the Baidu search engine and build your brand’s online reputation.

How to Connect with Chinese Consumers

Deliver the right message

As a historically imported commodity, wine has not yet found its roots in Chinese culture as part of the daily routine of most Chinese people. Being viewed as “exotic” can be a double-edged sword. On one hand, imported wines are still considered to embody a “sophisticated, Western” lifestyle. On the other hand, cultural differences can sometimes make it difficult for these wines to resonate with Chinese consumers. Therefore, having localized communication is crucial. Take Penfolds as an example: the brand’s Chinese name, “奔富,” is a phonetic transliteration of the original name, but with Chinese characters carefully chosen to mean “running towards wealth.” Similar examples can be found in Bordeaux Grand Cru Classe estate labels such as Chateau Beychevelle (“龙船” means “dragon boat” in Chinese), Chateau Giscours (“美人鱼” means “mermaid” in Chinese), and Chateau Leoville Las Cases(“雄狮” means “lion” in Chinese). The positive connotations of these brand names generate positive sentiment among Chinese consumers, which helps to build brand awareness. The message your brand delivers to Chinese consumers should be clear, easy to understand, and culturally appropriate.

The influencer phenomenon

Unlike the Western world, the wine market in China is very young. Not only does the wine market have a shorter history, but wine professionals and wine consumers in the region are younger in age as well. In China, there is no figure like Robert Parker serving as the trendsetter who convinces people to spend hundreds and thousands of dollars on wines from certain domains. Instead, influencers play a more important role in China’s community-based economy, turning the buying power of their audience into sales revenue.

The influencer economy, known as the KOL (key opinion leader) economy within the Chinese market, has been extraordinary, with unbelievable product sales records being broken within minutes in the beauty category. At the beginning of 2021, the record-setting sales of state-owned domestic wine brand Great Wall were generated by top influencers Viya and Li Jiaqi, who sold ten thousand cases of Great Wall wine in a mere 10 seconds. Lady Penguin (Wang Shenghan) is the best-known Chinese influencer in the wine sector. The Brown University graduate has been active on various social media platforms since 2014, promoting wine and wine culture by making them more accessible to Chinese consumers. With 3.8 million followers on Douyin, her Tmall shop ranked in the top 10 for sales revenue during the “9.9 Global Wine & Spirits Festival.” Lafei Bro is another influential figure on Douyin, with a backing of over 4 million followers. The WSET-certified wine professional is an executive team member of the leading online Chinese retailer of wine and spirits, Jiuxian.com, and reached sales of CNY 160 million in the first quarter of 2021 via livestreaming on Douyin.

Top wine influencers

- Viya: “Livestreaming Queen”, 18m followers on Weibo

- Li Jiaqi: “Lipstick King”, 29m followers on Weibo

- Lady Penguin: Entrepreneur, 1.45m followers on Weibo

- Lafei bro: Senior Partner at Jiuxian.com, 4.2 m followers on Douyin

- Terry Xu: Wine expert and lecturer, 460k followers on Weibo

- Li Demei: Winemaker, professor, 300k followers on Weibo

- Julien Boulard MW: Wine educator, blogger, 90k followers on Weibo

- Maxime Lu: Wine expert, blogger, 500k followers on Weibo

Professional media outlets and personalities

Just as wine critics are the trendsetters of the global wine industry, professional media outlets and personalities have a strong influence on Chinese audiences. Though not as popular as influencers, professional media outlets and personalities enjoy a strong base of wine lovers in their audience, with more loyalty and greater involvement, too. Wine educators and sommeliers like Fongyee Walker MW, Edward Ragg MW, Julien Boulard MW, Gus Zhu MW, Lu Yang MS and Terry Xu (aka Xiao Pi), and Jean-Marc Nolant (Lao Ma) all have a strong base of followers online as well as offline.

Professional wine media outlets and publications such as Taste Spirit, Vinehoo, Wine-World, and Wikiwine (Jiubaike) have all built solid audiences through their high-quality content. These outlets for Chinese-language wine information and publications are better known within China than international wine media like Decanter or Wine Spectator.

Conclusion

In summary, although the wine market in China has great potential and holds extraordinary opportunities for brands, it will not prove easy to conquer. Because of the country’s short history of modern winemaking and wine consumption, it takes more time and much more effort to build a brand in China. The fragmented nature of the wine industry, the language and cultural differences between the Western world and China, and the consumption behavior of Chinese consumers are all important factors to consider when defining a brand strategy for the Chinese market.

E-commerce and digital platforms open the door to the public, but online competition is fierce. Wine faces competition from low-alcohol drinks as well as ready-to-drink cocktails, which are more accessible and require less knowledge for general consumers. Effective communications and online interactions can generate positive sentiment from consumers and build brand awareness, and it is extremely important to keep up with the ever-changing consumer habits and trends. Applying the same strategies used in traditional wine markets or other emerging markets may not be as effective in China. Ultimately, a brand’s strategy must be market-oriented and consumer-oriented to ensure sustainable success in the Chinese market.